Micro and Alternative Credentials are a fast growing segment of digital post-secondary learning.

As drivers for change in post-secondary education strengthen, micro-credentials are set to play a critical role in supporting ongoing learning and up-skilling, both within and outside traditional providers of education and training. While the space is still forming, and multiple models and approaches abound, there are clear signals of emerging standards, definitions and recognition of micro-credentials. This, along with digital infrastructure to support adoption at scale, is likely to lead to broad acceptance of micro-credentials sooner rather than later.

$2.6T was spent in 2019 on post secondary education and workforce training and up-skilling.

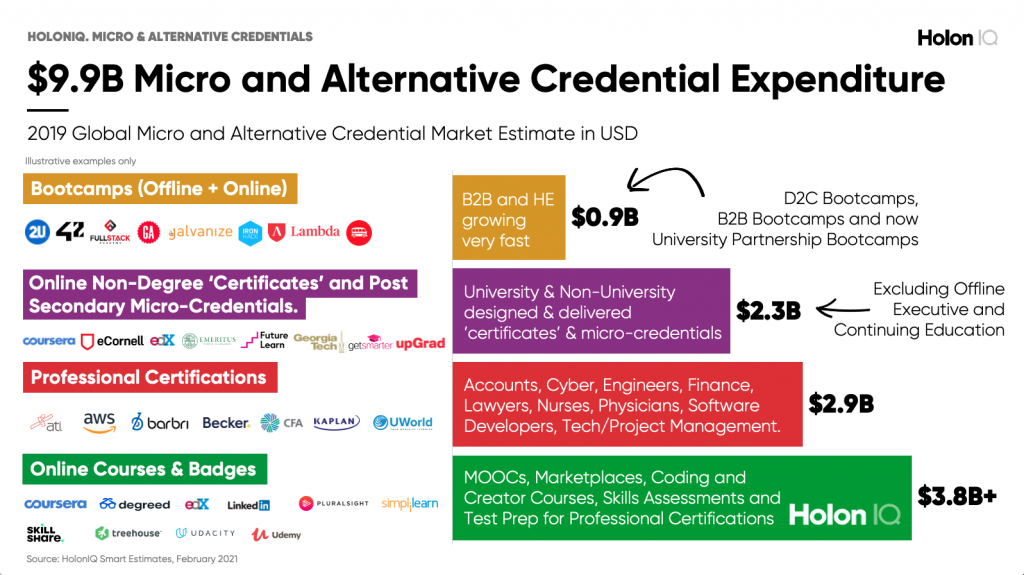

Formal degrees are by far the largest component of the overall post-secondary education market with a total spend of $2.2T in 2019 (pre-COVID). Made up of mostly face-to-face learning (pre-COVID) in formal, assessed, accredited qualifications, tuition deflation pressure and changing demographics are gradually compressing this enormous market. COVID-19 has precipitated change and accelerated the fully online degree market, which stood at $36B in 2019. Although growing fast, the global alternative and micro-credential market still only accounted for $10B in 2019. 2020 initiated explosive growth and a key question for the future is to what extent the traditional in-person degree market will be supported by, transformed into, or replaced by, online degrees or alternative and micro-credentials?

.png)