Clinical, digital and analytical advances are driving a focus on prevention and ‘smarter’ healthcare

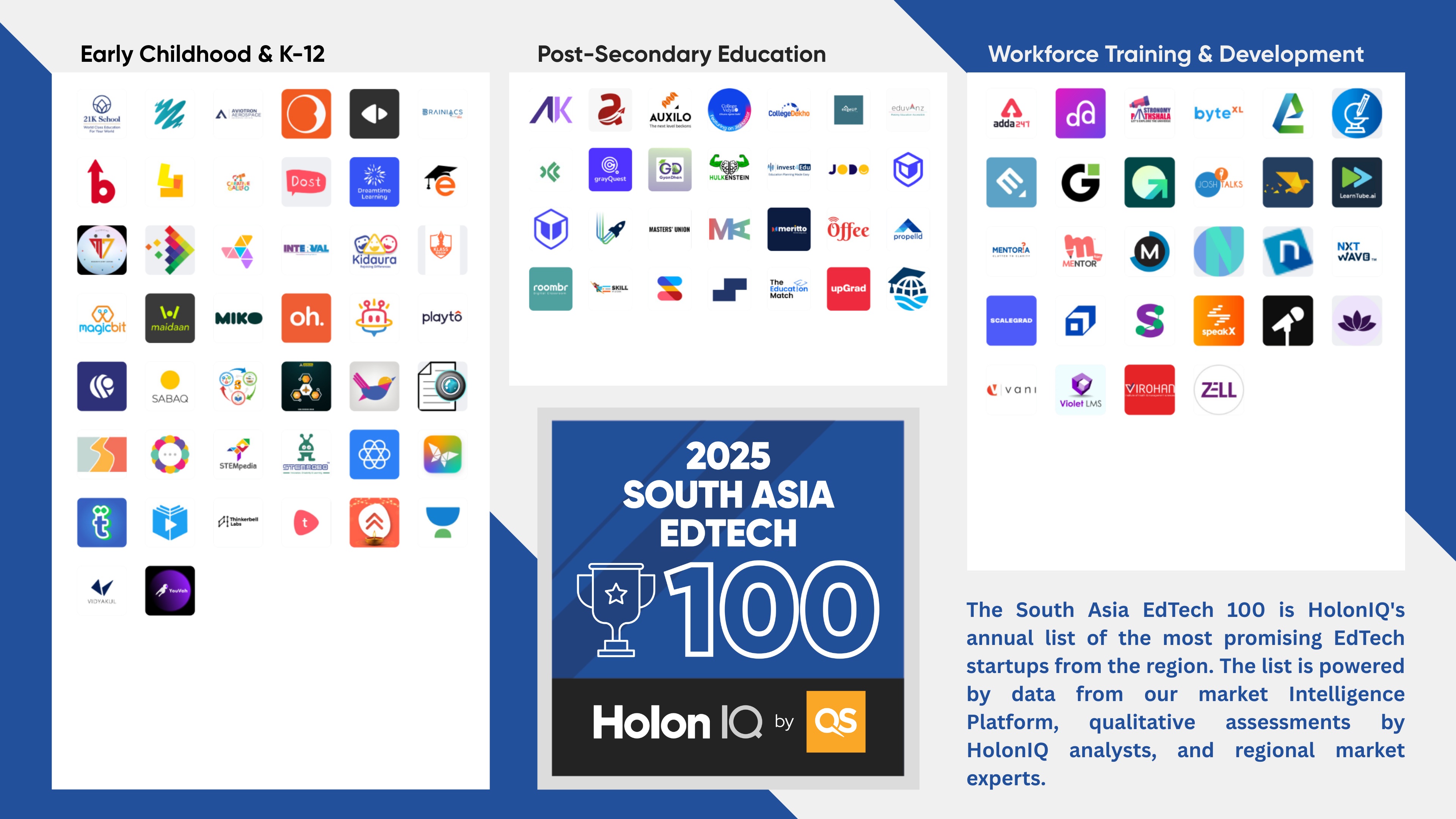

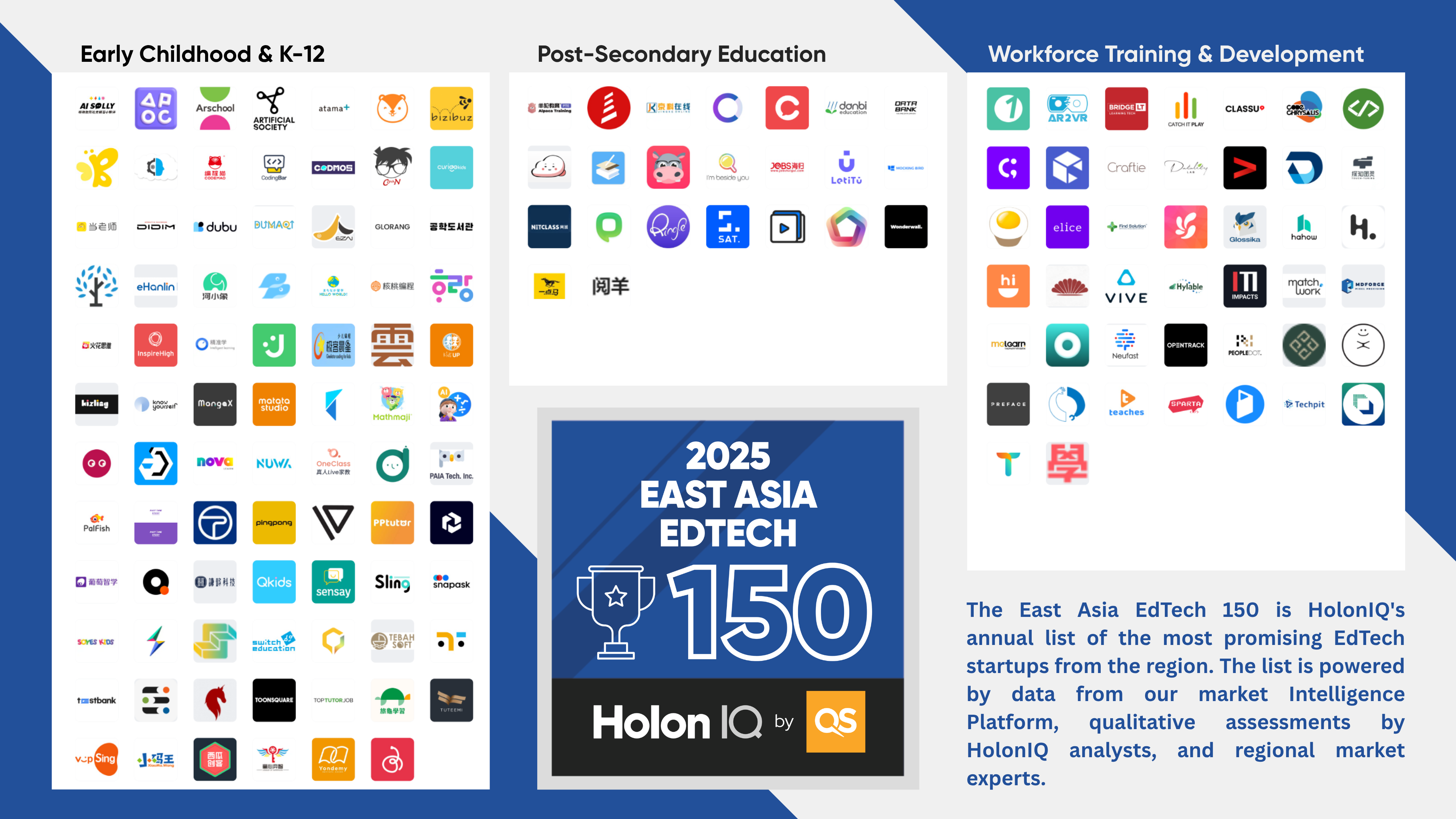

Every year, HolonIQ’s Health Intelligence Unit identifies the top 1000 Health Tech startups around the world. By mapping the 2021 cohort to the Global Healthcare Landscape we’re able to gain a deeper understanding of where entrepreneurial talent is focused in healthcare - and which areas of the market are driving innovation.

The Health Tech 1000 is built region by region from over 10,000 nominations, applications and screening to ensure the global cohort is diverse and to shine a light on the inspiring innovation happening all around the world.

Exhibit 1

Applications for the 2022 Global Health Tech 1000 are now closed and each regional list will be announced at our Global Impact Summits Sep-Nov 2022. Please also check our 30 individual maps for the 2021 Global Health Tech 1000, EdTech 1000 and Climate Tech 1000.

The Global Healthcare Landscape encompasses all organizations working across healthcare. The Taxonomy provides an organizational structure that helps to make sense of what is often a complex and hyper-local sector and map and track this evolving market. Companies are allocated first to sub-sectors and within those sub-sectors they are classified into clusters.

When viewed through the prism of the Global Healthcare Landscape, the 2021 Health Tech 1000 provides a visual representation of where entrepreneurial focus is concentrated currently; a heat map of sector innovation and investment opportunity.

Clinical research gains and personal health focus a silver lining from pandemic

As nations continue to emerge from the Covid-19 pandemic it is already all too apparent the experience has left great scars across global healthcare systems and society generally. Following a period of unprecedented prioritization of clinical research and vaccine development it is perhaps unsurprising Research is the largest sub-sector across our cohort. With nearly a quarter of all organizations represented focused on Prevention and Diagnosis it is also clear that personal health remains a high priority for individuals. The 2021 Health Tech 1000 consists of many organizations with B2C propositions concentrated on wellbeing, mental health and other aspects of physical health.

The greater utilization of digital across healthcare globally is also represented in the chart, with technology specialists increasingly applying machine learning and artificial intelligence methodology to healthcare’s antiquated data infrastructure. Soaring usage of telehealth over the period has profoundly changed the landscape for investors and entrepreneurs.

Exhibit 2