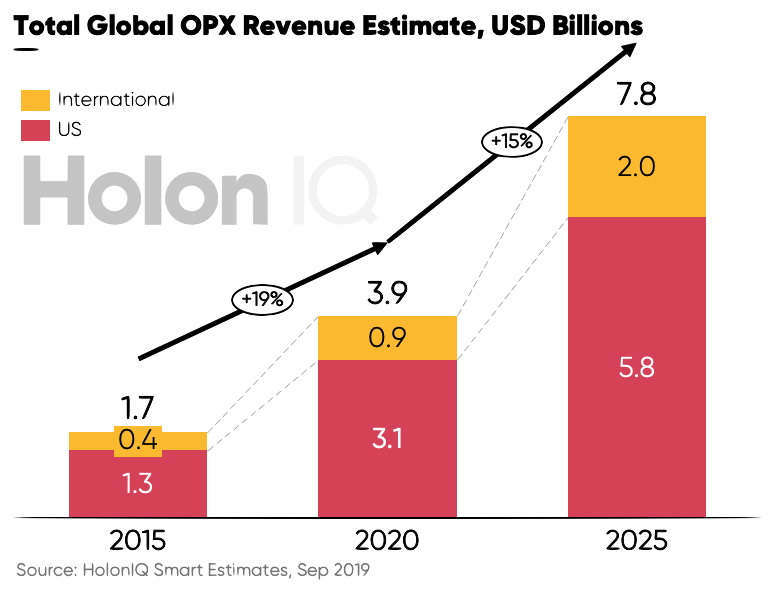

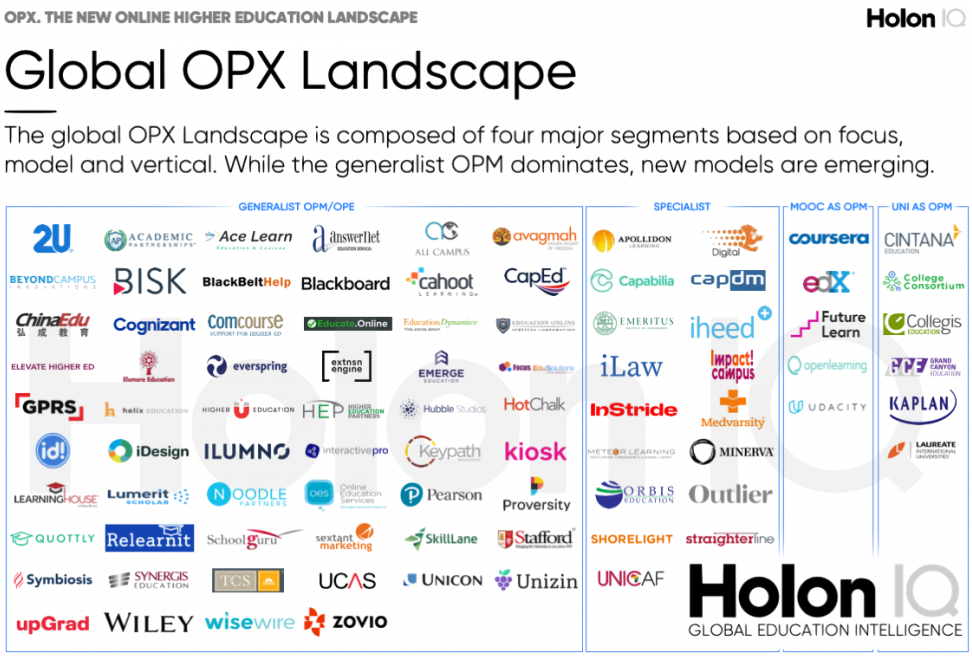

OPX is a new category, collectively defining the entire spectrum of services models supporting Universities in the design, development and delivery of online higher education. The OPX category is a $3.5B+ market today, growing at 15% and expected to reach $7.8B by 2025. It includes OPM, OPE, MOOC-as-an-OPM and new hybrid and innovative models.

While the traditional OPM model still dominates, OPE’s, MOOCs and new combinations of capabilities and economic models are maturing and accelerating online program services into higher education.

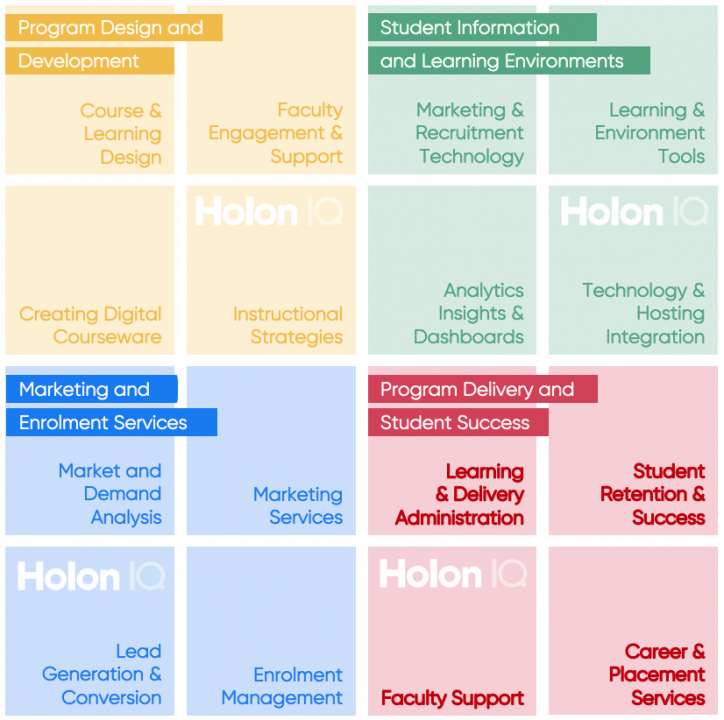

Our 16-point Open Source, OPX Capability Framework serves to benchmark core capabilities that Universities and OPX’s require to effectively and sustainably design, develop and deliver online higher education.

OPX. By the Numbers.

There are currently 80+ OPX providers working with 500+ global universities to support all aspects of the design, development and delivery of online higher education. This $3.5B market is growing at 15% to $7.8B by 2025.

Of our 4,900+ OPX Program dataset, 1 in 3 are business credentials, nearly 1 in 5 are from healthcare and just under 1 in 10 are in STEM.

The US currently dominates the global OPX landscape with over 80% share, however, this will shrink to just under 75% over the next five years as the global appetite for the OPX model gains traction.

Lean more about our OPM, MOOC and OPX Research and Data.

HolonIQ’s Global Market Intelligence Platform provides detailed information, data, and analysis on the Global OPM Market with ongoing coverage of this evolving landscape.

.png)