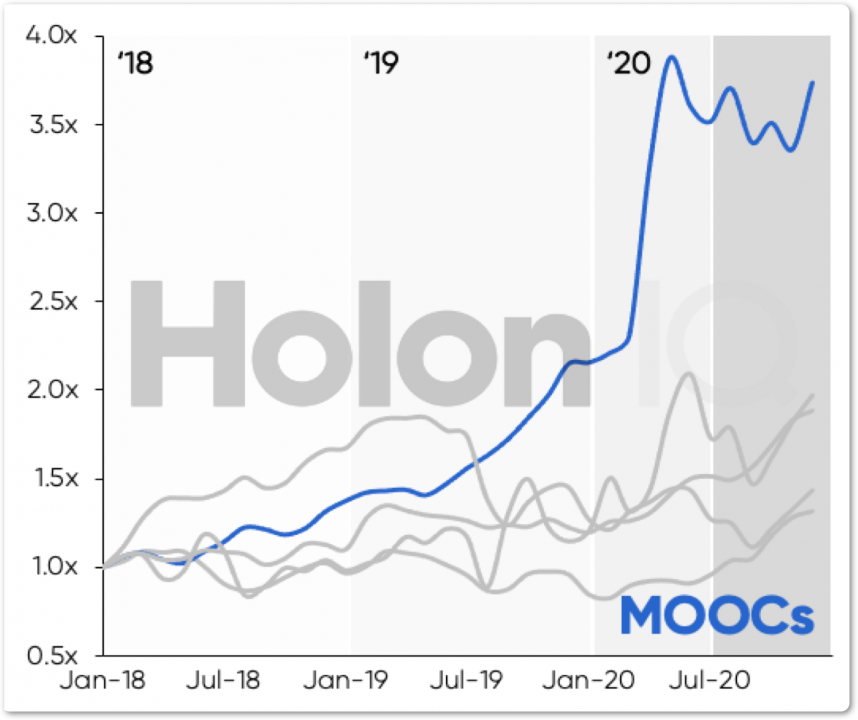

EdTech Digital Reach doubled over the last 3 years. MOOC’s nearly achieved 4x growth. We've been applying our core computational engines across a range of experiments to benchmark the digital reach of companies and categories in education technology.

In 2020 we set out to build ‘HUM’, one of HolonIQ’s core computational engines. HUM is designed to build and benchmark real-time indices that measure the change in a group of individual data points, much like say the MSCI, FTSE, S&P100 or Dow Jones does for stocks. More generally, we set out to build indices that allowed us to track growth, performance, risk and health from different perspectives and ultimately provide predictive insights into social and economic trends.

We applied the first version of HUM to develop HolonIQ’s Global Impact and SDG Stock Indices. This set of indices measures the performance of nearly 1,500 stocks powering social and economic impact across 9 Impact sectors and 17 Sustainable Development Goals (SDGs). This initial work also led to the development of the world’s first Education Technology and Digital Learning Index in partnership with Foxberry and subsequently, the world’s first ‘EdTech ETF’ or Exchange Traded Fund (LERN) in partnership with RIZE.

Experimental Digital Reach Indices.

The COVID-19 pandemic has brought heightened awareness of how powerful education technology can be to support education delivery and learning, as well as offering a stark reminder of the digital divide and inequality of access that reliance on technology brings.

Through 2020, we saw the rapid acceleration of EdTech. We observed the digital reach of MOOC’s growing 2.5x through the first half of 2020 (at one point by approximately 300 million monthly visits globally), as isolated learners sought immediate solutions to their knowledge and skills needs amid a rapidly-evolving work landscape.

Through the second half of 2020, HolonIQ’s Data Science team further developed HUM to help us learn more about how Global EdTech’s digital reach was evolving. Below is a small selection of our first experimental insights.

Based on web-traffic reach estimates and leveraging our open-source Global Learning Landscape taxonomy, HUM now builds digital reach indices for core categories and clusters, statistically weighting the underlying performance of up to 100 top organizations per category in each index. For example, the MOOC Digital Reach Index provides insights into the weighted performance of 100 of the world’s top MOOCs. Not just Coursera, edX, FutureLearn et al, but the top 100 MOOCs around the world tracked by HolonIQ’s Global Intelligence Platform.

MOOC Growth.

MOOCs started the last decade as a proof of concept and finished with 380 million students taking over 30 thousand courses and 50 degrees from over 1,000 Universities globally (almost all published MOOC research statistics ignore China, emerging markets, workforce focused MOOCs and the long tail of niche-platforms).

MOOC’s saw explosive growth through 2020, building on an already very strong 2018 and 2019. The borderless digital market for ‘just-in-time’ skills and knowledge is highly competitive and represents a rapidly evolving part of the post-secondary education landscape.

OPM Partnerships.

OPMs, or Online Program Managers, are companies that partner with universities to build, recruit for and deliver online programs. Revenue share is the dominant commercial model with fee for service and hybrid relationships growing. Universities are establishing public-private partnerships at a growing rate as the Higher Education model evolves, with the COVID pandemic accelerating the move to fully online learning.

Even before COVID, the online degree market was one of the fastest-growing segments of higher education globally, forecast to reach $74B by 2025. The pandemic has dramatically accelerated online delivery, including a rapid expansion of the university-OPM model, with 800+ universities engaging with OPM providers.

.png)