OPX has well and truly arrived. 2U's acquisition of EdX. Coursera's IPO. SEEK's 50% stake in FutureLearn and their ownership of OES. UpGrad's rumored $4B valuation. Shorelight Live. Minerva's OPM pivot. The list goes on, and meanwhile 244 University Partnerships were forged in the first half 2021.

We’re firmly at that point on the innovation spectrum in Higher Education Technology where the old categories and acronyms don’t work anymore, but the landscape is mid-shift and the new dominant models are not so clear yet.

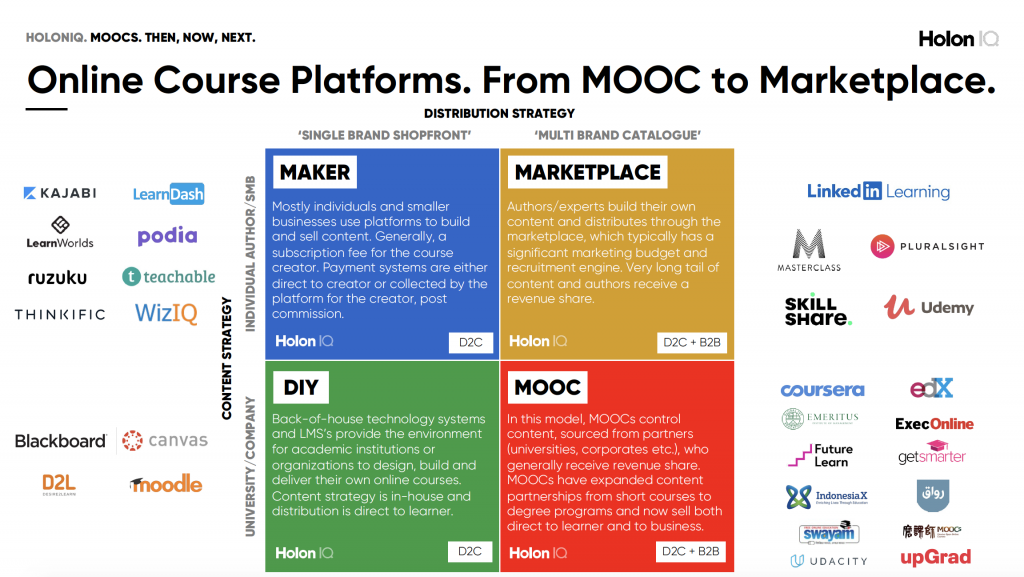

In 2019, we connected some dots by identifying OPX as a new meta-category. Collectively defining the entire spectrum of tech-enabled services models, supporting Universities in the design, development and delivery of online higher education, including Online Program Managers (OPMs), Online Program Enablers (OPEs), MOOC-as-an-OPM and new hybrid and innovative models.

In 2018, we started closely tracking the growth in University-led ‘Academic Public-Private Partnerships’, which are on track to see more than 450 new partnerships established in 2021 after a massive first half-year. After a big Q1 2021 (109 new partnerships), we expected to see at least 400 Presidents, Vice Chancellors and Deans to sign up a new partner over the course of 2021. But with Q2 2021 delivering another 135 partnerships, we’ve elected to bump that outlook up by another 50 partnerships and would not be surprised to be upgrading that outlook at the Q3 mark at this rate.

2U's acquisition of EdX Assets (brand, website, and marketplace) marks a distinctly new chapter for the OPM and MOOC. The three dominant MOOCs are now either acquired or public companies and the 'free to degree' spectrum is a highly competitive, yet distinctly diverse array of partners, players and models.

Coursera’s IPO was highly anticipated, SEEKs acquisition of 50% of FutureLearn was somehow both surprising and understandable; but 2U’s move to acquire the assets of EdX, for most, came out of nowhere.

The screenshot below, from HolonIQ’s Impact Intelligence Platform, charts the volume and sentiment of signals (press releases, wires, news and notable blogs) mentioning 2U OR EdX over the 90 days prior to the deal announcement. Zooming out, it’s clear to see the overwhelmingly positive sentiment to the transaction. We’ve seen some neutral reactions and a handful of folks not so pleased to see the EdX story appear to conclude, with an acquisition.

This is the third of 2U’s power-plays. First Get Smarter (Short Courses), then Trilogy (Bootcamps) and now EdX (MOOC), which illustrate the convergence and hybridization of the post-secondary degree to workforce up-skilling segment.

.png)