EdTech Venture Capital is moderating with fewer mega-deals and a $1.6B Q3, signalling a lower 2019 year-end forecast

HolonIQ tracks every single education transaction globally. From Seed to Venture, Growth Stage to LBO, IPO and Take Private. This is our quarterly VC flow update.

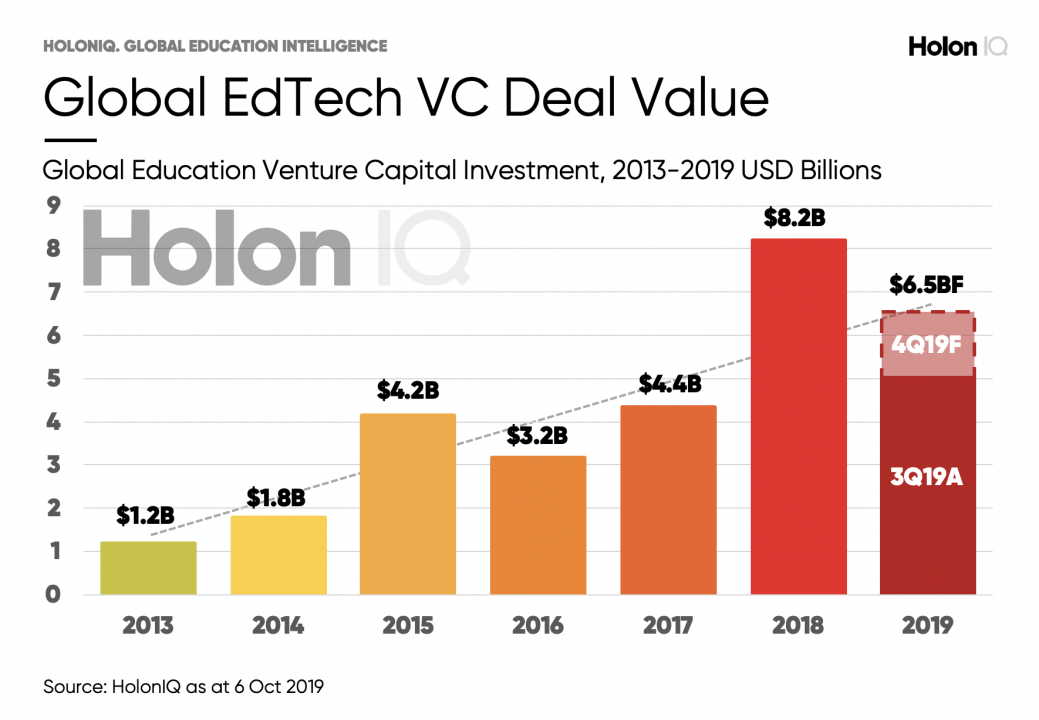

$6.5B Full Year EdTech VC Forecast for 2019

EdTech VC investment in 2018 was absolutely unprecedented, almost double 2017 investment levels. At 2Q19 we saw $3.5B of EdTech VC through the first half and at that time we estimated 2019 could reach as much as $7.5B of EdTech VC.

At 3Q, we are downgrading our outlook for 2019 by almost $1B and estimating the year closes out at $6.5B. While there are a number of mega-deals in the market still searching for the right investors and terms, we have seen a significant slow down of mega-deals out of China and weaker than normal underlying activity through 3Q globally.

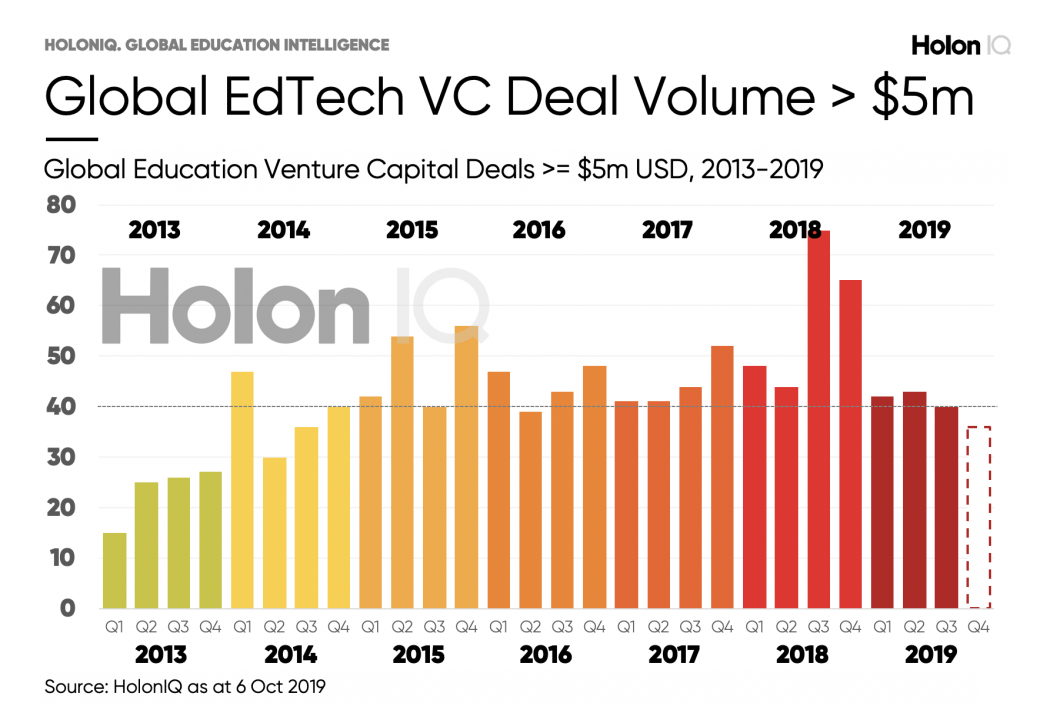

40 Deals per Quarter > $5m

The total value of education venture capital transactions each quarter is moderating at around 40 that are over $5M in size.

Q1 2015 was the first time the world reached that volume of transactions > $5m and since 2016, Q3 and Q4 have generally surged ahead than the first half.

However, we don’t see 2019 following the trend. Whilst we expect at least two Mega Rounds, overall our expectation is for Q4 to moderate slightly and close what will still be an extraordinary year in EdTech VC.

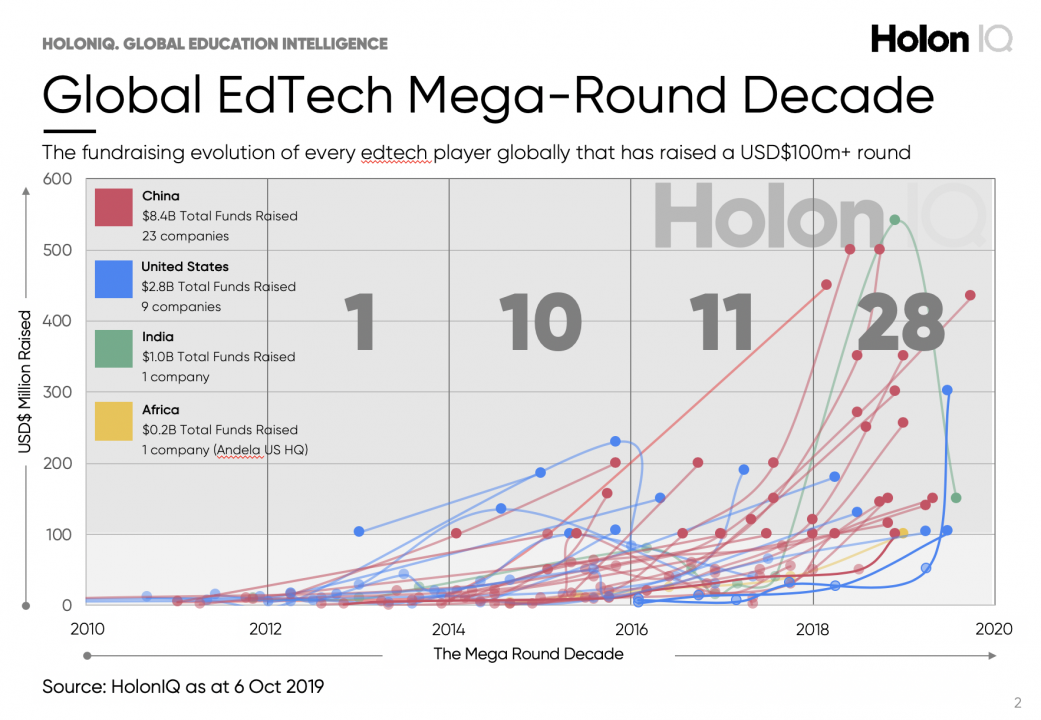

2018 appears to be a Mega Round outlier

The biggest change since the start of 2018 was the acceleration of the Chinese mega-investment round. Most months since January 2018 included a $100M+ VC round.

While 3Q 2019 has seen a number of Chinese and Indian Mega Rounds, namely Zhihu and Byju’s, Coursera was the highest-profile US transaction in 1H 2019.

As time goes by and we zoom out and track the evolution of Mega Round companies, the lower rate of activity in 3Q and anticipated moderation in Q4 is suggesting 2018 really was China Mega Round driven outlier.