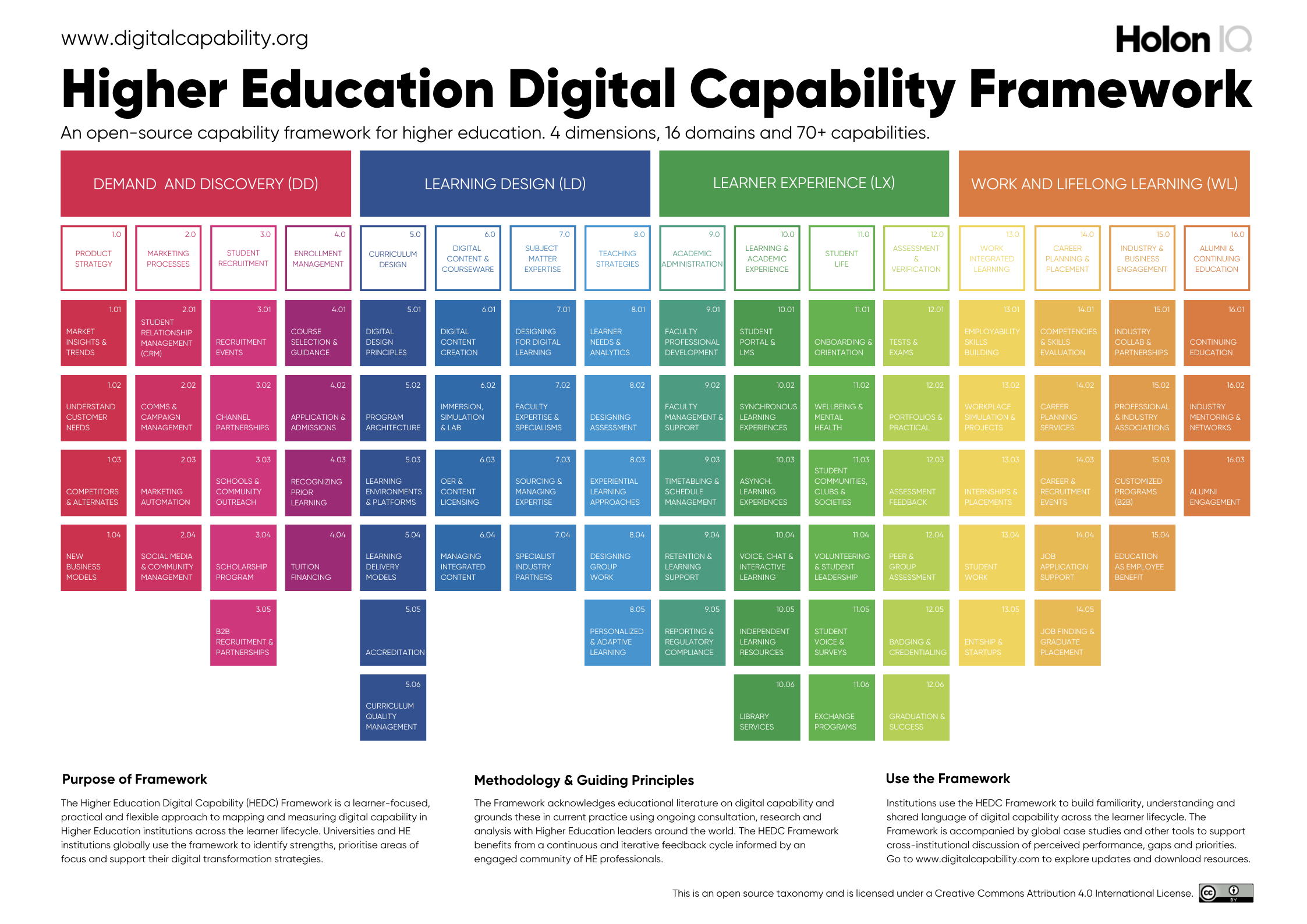

Initial insights from our first survey on digital capability in higher education suggests that process & people are the biggest capability gaps and 'Learner Experience' is ranked last on performance. 'Learning Design' & 'Learner Experience' are the main priority for higher education institutions globally.

Initial Insights Report

Based on responses from 300+ University Leaders and Industry Executives from 30 countries, the report provides perspectives on the current state of digital capability in higher education, including performance and priorities across the student lifecycle.

.png)