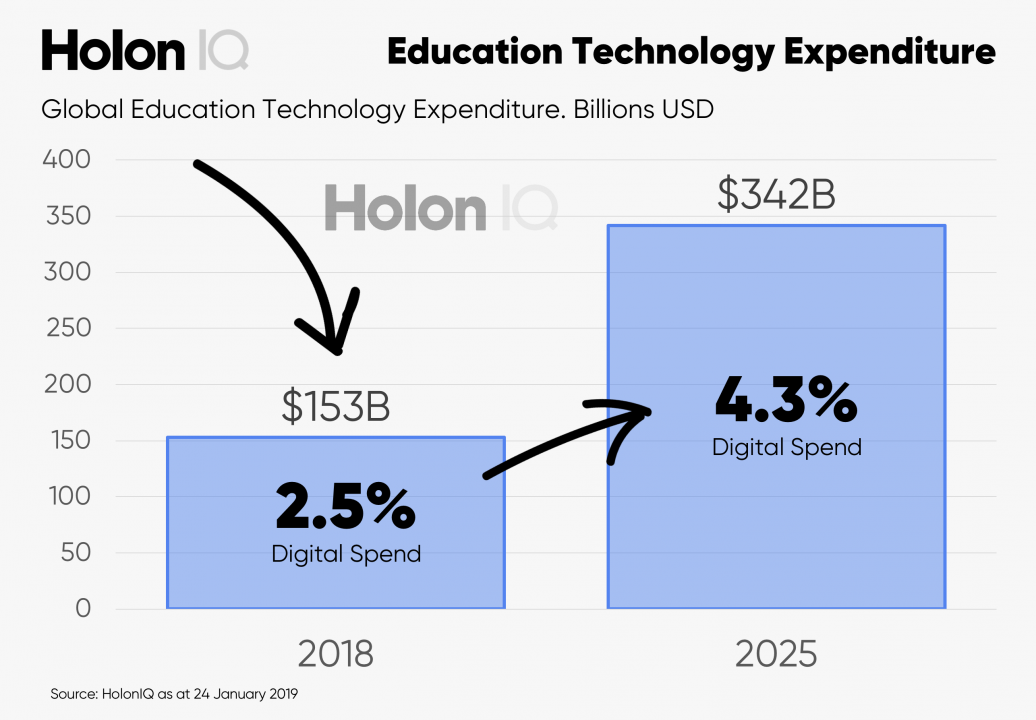

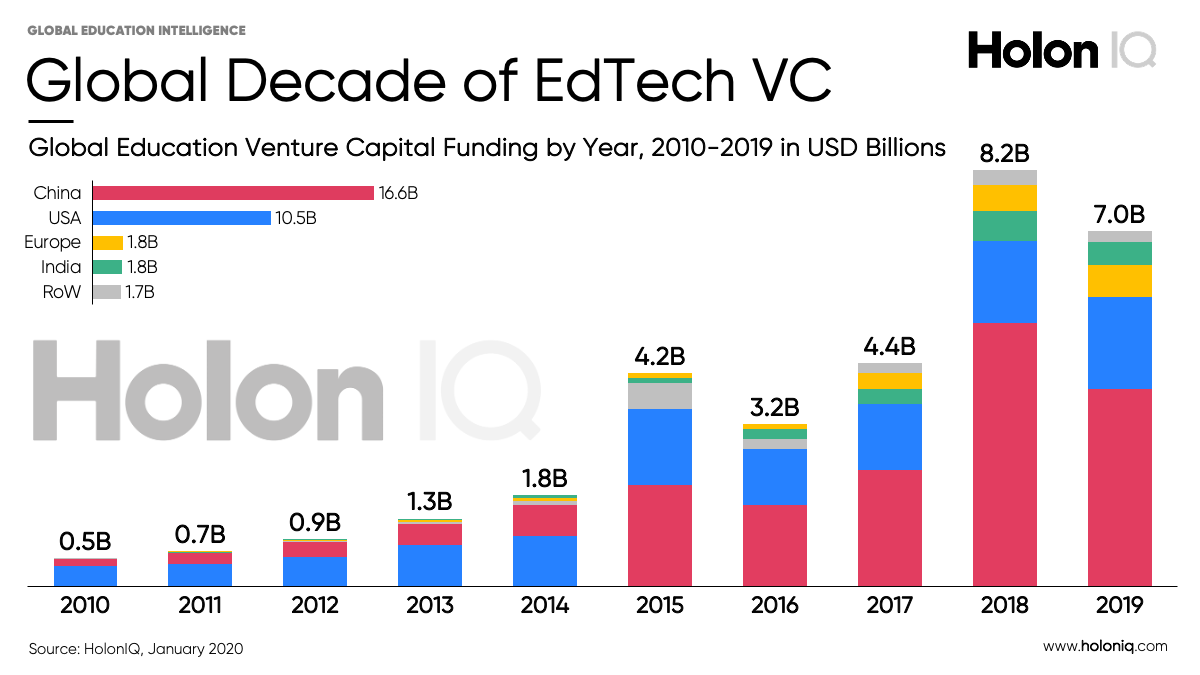

EdTech started the decade with $500m of Venture Capital investments in 2010 and finished 14x higher at $7B in 2019. We expect over $87bn to be invested over the next 10 years, almost triple the prior decade.

Every January, we look back on the prior year to reflect on Venture Capital investment in education technology. This January marks the close of an extraordinary decade for education technology with over $32B in funding backing a vision to transform the way the world learns and supporting the United Nations Sustainable Development Goal four (SDG4). HolonIQ’s dataset of investments in the global education market powering this analysis has now reached over 18,500 transactions and is available from Q2 as an annual SaaS subscription.

Global EdTech Venture Capital will nearly triple over the next decade.

EdTech started the decade with $500M of Venture Capital investments in 2010 and finished 14x higher at $7B in 2019, down 18% off a 2018 high of $8.5B in VC funding. China made up 52% of the last decade’s EdTech VC funding, the US represents 33% followed by Europe, India and the Rest of the World, each investing about 5% of the global funding total.

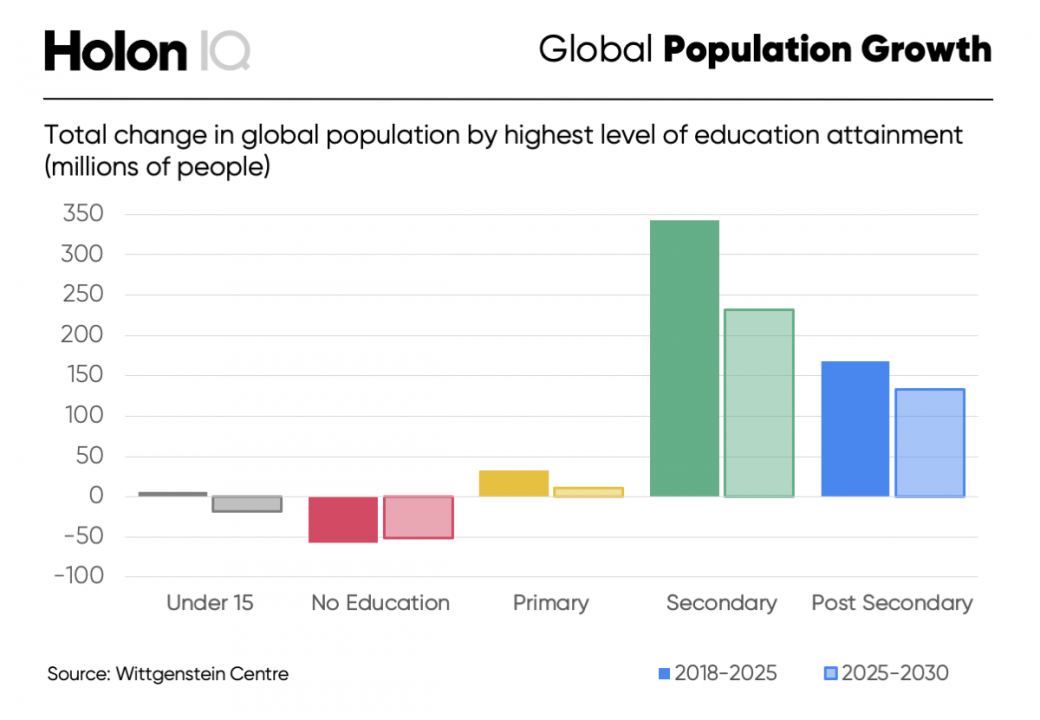

Emerging Markets such as Africa, Latin America and Southeast Asia are growing rapidly and have large under-served populations looking to leapfrog traditional developed education systems to lower cost and improve access and outcomes, supporting learners, teachers and administrators with advanced technology. The latter half of the next decade may well see investment traction in large emerging markets, particularly Southeast Asia, India and Latin America, where multi-billion dollar funds are being set up to deploy capital into education and other impact sectors.

.png)