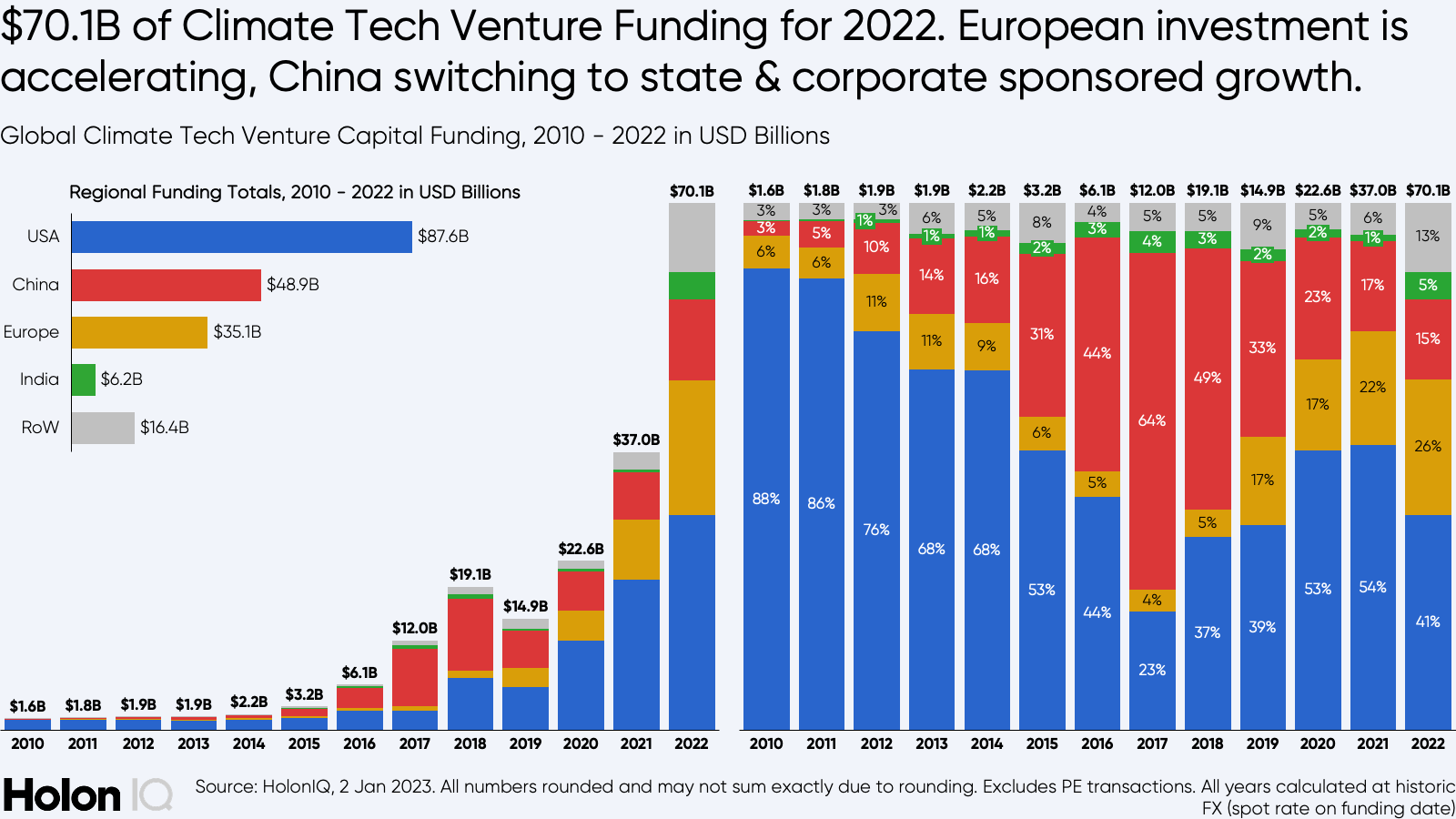

Global Climate Tech Venture Capital had an exceptionally strong 2022 delivering $70.1B of investment, defying gravity in a broader market that has fallen significantly. Expect 2023 to moderate amid a challenging economic backdrop, however Climate Tech will enjoy preferential allocation and has mobilized a focused investor base competing for quality flow.

2022 was an enormous year for Climate Tech VC. The US invested more Climate Tech VC in 2022 than the entire 2006-2011 Clean Tech 1.0 Boom and at the current pace of investment, by the end of 2023, the US will have invested over $100B in VC since then. Europe's venture funding into Climate Tech more than doubled in 2022, out investing China for the first time and together with a huge rise in India and around the world, grew 89% globally on 2021's record.

HolonIQ's quarterly wrap on Climate Tech VC is based solely on our proprietary impact intelligence platform. All data is sourced directly by HolonIQ technology and analysts from public disclosures and private submissions by governments, companies and investors around the world. This analysis is focused exclusively on venture capital and as such we exclude all private equity buyouts, corporate subsidiary funding, project finance, public funding, grant and academic funding to ensure we are primarily tracking flows of venture focused equity risk capital.

Climate Tech Venture investment is now 40x larger than it was a decade ago. With innovation surging across the entire Climate Tech Landscape, notable mega rounds included 🇸🇪 Northvolt's $1.1B growth round, 🇺🇸 TeraWatt’s $1.0B Series A, 🇺🇸 TerraPowers $750M+ growth round, 🇨🇳 RT Advanced Materials $740M, 🇨🇳 Voyah's $700M Series A, 🇨🇭Climework's $650M growth round and 🇺🇸 EnergyX's $450m growth round joining 160+ other companies that closed a $100M+ Mega Round in Climate Tech through 2023.

As of 2 January 2023, there are 83 Climate Tech Unicorns around the world who are now collectively valued at $180B+. 2022 saw a new Climate Tech Unicorn every two weeks on average, with a range of public market exits, SPACs a popular route as the traditional IPO proved challenging more broadly.

Figure 1

Global growth of 89% in Climate Tech VC was achieved through growth in all major markets. The US leads VC investment in Climate Tech today, taking over from China in 2019 as regulatory changes have enabled state sponsored and corporate companies to effectively take over from traditional VC's who now invest alongside those corporations.

The US has seen strong investment momentum quite recently and by mid to late 2023, the US alone will have invested over $100B of VC into Climate Tech since 2010. The original Clean Tech Boom from 2006 to 2011 saw investors commit $25B+ of VC. With such a strong wave of Climate Tech VC through 2022, the comparison with Clean Tech 1.0 will diminish, so long as this wave is sustained.

Figure 2

.png)